The insurance sector is undergoing a major transformation due to new regulatory changes. These rules aim to enhance transparency, protect consumers, and promote fair competition. Whether you’re an insurer, policyholder, or investor, understanding these changes is crucial. This in-depth guide explores the latest regulations, their impact, and how businesses and consumers can adapt.

A. Overview of the New Insurance Regulations

Governments and financial authorities worldwide are introducing stricter rules to modernize the insurance industry. Key areas of reform include:

-

Consumer Protection – Stronger safeguards against unfair practices.

-

Capital Requirements – Insurers must maintain higher reserves.

-

Digital Compliance – Enhanced cybersecurity and data privacy rules.

-

Climate Risk Disclosure – Mandatory reporting on environmental impacts.

These changes aim to create a more stable and customer-friendly insurance market.

B. Key Changes in the Insurance Sector

1. Stricter Capital and Solvency Rules

-

Insurers must hold more capital to cover potential losses.

-

Prevents insolvency risks during economic downturns.

-

Aligns with Basel III and Solvency II frameworks.

2. Enhanced Transparency in Pricing

-

Companies must justify premium increases.

-

Prevents hidden fees and discriminatory pricing.

3. Mandatory Climate Risk Disclosures

-

Insurers must assess and report climate-related risks.

-

Encourages sustainable underwriting practices.

4. Stronger Data Privacy Measures

-

GDPR-like rules for customer data protection.

-

Penalties for breaches and misuse of personal information.

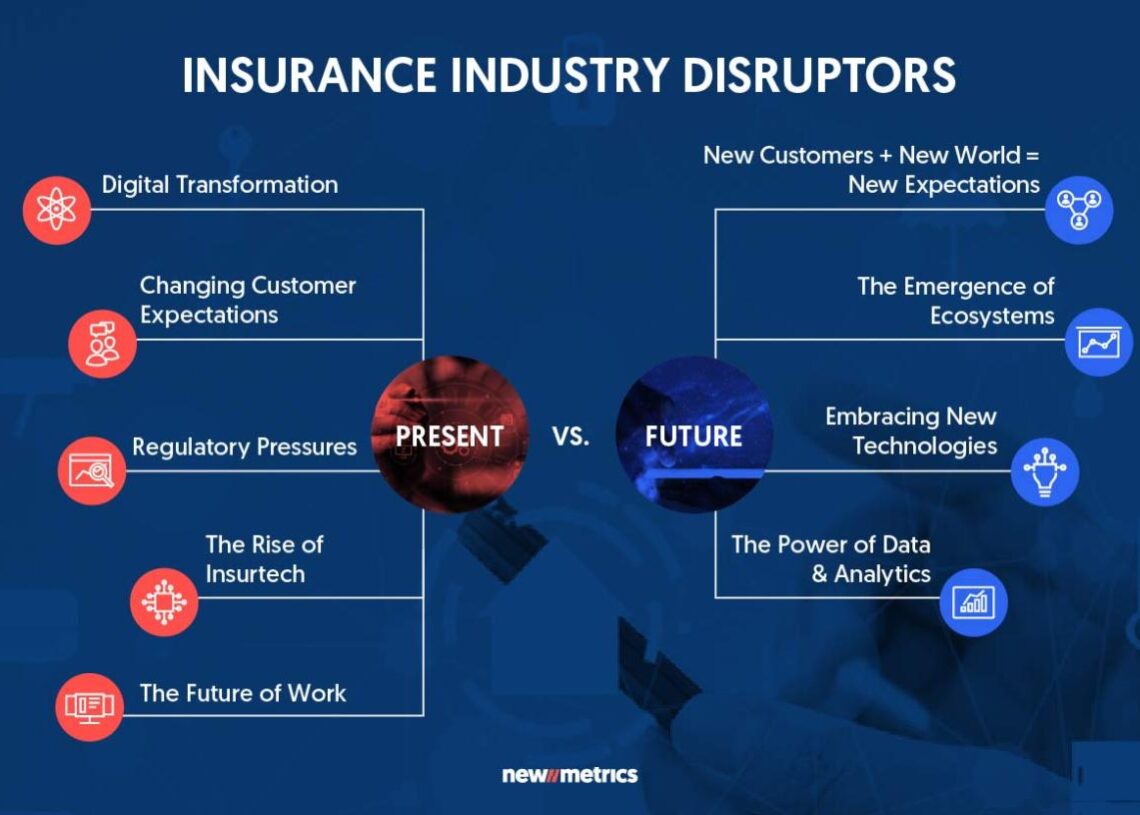

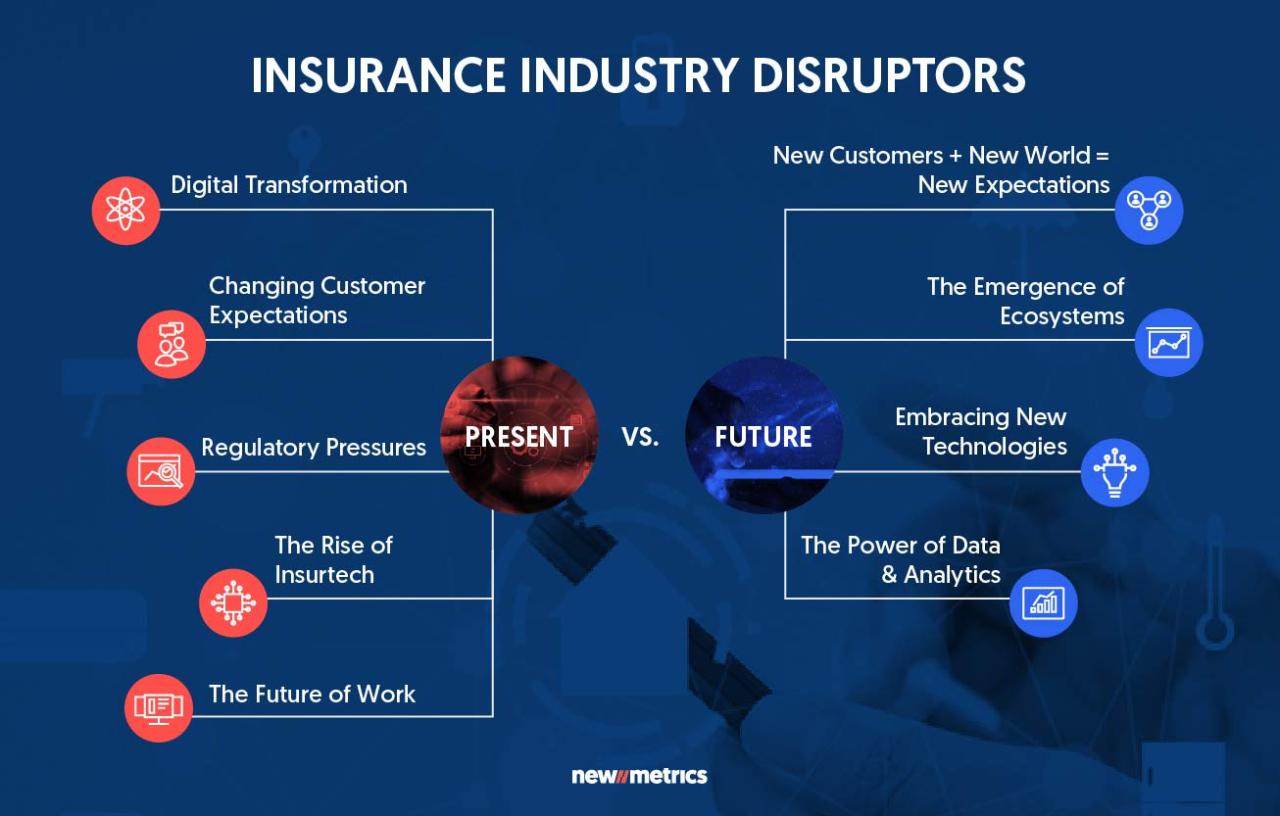

5. Digital Transformation Requirements

-

Insurers must adopt AI, blockchain, and digital claims processing.

-

Faster, fraud-resistant services for policyholders.

C. Impact on Insurance Companies

1. Increased Compliance Costs

-

More spending on legal, IT, and risk management teams.

-

Smaller insurers may struggle to adapt.

2. Shift Toward Sustainable Policies

-

Growth in green insurance products (e.g., eco-friendly home coverage).

-

Reduced support for high-risk industries (e.g., fossil fuels).

3. Greater Use of Technology

-

AI-driven underwriting and fraud detection.

-

Chatbots and mobile apps for customer service.

4. Mergers and Acquisitions (M&A) Surge

-

Smaller firms may merge to meet capital requirements.

-

Big players acquire insurtech startups for innovation.

D. How Policyholders Are Affected

1. Better Consumer Protection

-

Clearer policy terms and fewer hidden clauses.

-

Faster claim settlements due to automation.

2. Possible Premium Increases

-

Higher capital rules may lead to costlier premiums.

-

Discounts for low-risk customers could rise.

3. More Personalized Insurance Plans

-

Usage-based insurance (UBI) for cars and health.

-

Dynamic pricing based on real-time data.

E. How Insurers Can Adapt

1. Invest in Compliance Technology

-

Regtech solutions for automated reporting.

-

AI-powered risk assessment tools.

2. Expand Sustainable Insurance Offerings

-

Green home, auto, and business insurance products.

-

Incentives for eco-friendly policyholders.

3. Enhance Cybersecurity Measures

-

Stronger encryption and fraud detection systems.

-

Regular audits to prevent data breaches.

4. Educate Customers on New Policies

-

Transparent communication about changes.

-

Digital platforms for easy policy management.

F. Future Trends in the Insurance Industry

-

AI and Machine Learning – Faster claims, fraud detection.

-

Blockchain – Secure, tamper-proof policy records.

-

Parametric Insurance – Payouts based on real-time data (e.g., weather triggers).

-

On-Demand Insurance – Short-term coverage via apps.

Conclusion

The new insurance regulations bring both challenges and opportunities. While compliance costs may rise, these changes foster a more transparent, tech-driven, and customer-centric industry. Insurers that adapt quickly will thrive, while consumers benefit from fairer, more innovative policies.

Tags: insurance regulations, new insurance rules, Solvency II, climate risk insurance, insurtech, consumer protection, digital transformation, sustainable insurance, compliance, policyholder rights