Insurance premiums are climbing at an unprecedented rate across all sectors – from auto and health to home and business coverage. This alarming trend is squeezing household budgets and forcing businesses to rethink their risk management strategies. In this comprehensive 2,000+ word analysis, we’ll uncover the real drivers behind these increases, examine their long-term implications, and provide actionable advice for consumers to mitigate the financial impact.

A. The Current State of Insurance Premiums

Recent data reveals shocking premium hikes:

-

Auto insurance: Up 19% year-over-year (2023-2024)

-

Health insurance: Average 7% increase for employer plans

-

Homeowners insurance: 23% surge in high-risk states

-

Business insurance: 15-30% higher for liability coverage

These spikes far outpace general inflation, creating a crisis for policyholders.

B. Primary Factors Driving Premium Increases

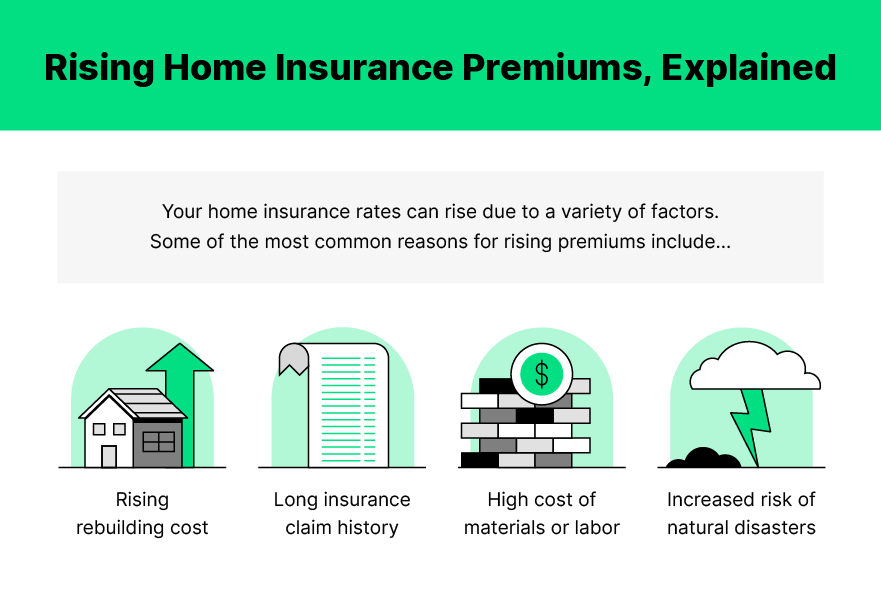

1. Climate Change Catastrophes

-

2023 saw $100B+ in global insured losses from natural disasters

-

Increased frequency of hurricanes, wildfires, and floods

-

Insurers passing rebuilding costs to all policyholders

2. Healthcare Cost Inflation

-

Hospital prices rising 5-7% annually

-

Expensive new specialty drugs (e.g., $3M gene therapies)

-

Aging population requiring more care

3. Legal System Abuse

-

Nuclear verdicts ($10M+ jury awards) becoming common

-

Social inflation adding 5-15% to liability premiums

-

Frivolous lawsuits driving up defense costs

4. Supply Chain Disruptions

-

Auto repair costs up 40% since 2020

-

Construction material prices 35% higher

-

Longer repair times increasing claim payouts

5. Reinsurance Market Pressures

-

Global reinsurance rates up 30-50%

-

Catastrophe bonds becoming more expensive

-

Reduced capacity forcing primary insurers to raise rates

6. Fraud Epidemic

-

$80B lost annually to insurance fraud in US alone

-

Sophisticated organized crime rings targeting insurers

-

Need for more expensive fraud detection systems

7. Investment Income Decline

-

Lower bond yields reducing insurer profits

-

Forcing companies to rely more on underwriting income

-

Requires higher premiums to maintain profitability

C. Geographic Variations in Premium Hikes

| Region | Auto Increase | Home Increase | Key Drivers |

|---|---|---|---|

| Florida | 35% | 40% | Hurricanes, litigation |

| California | 25% | 30% | Wildfires, inflation |

| Texas | 20% | 25% | Hail storms, population growth |

| Midwest | 15% | 18% | Severe weather, labor costs |

D. How Different Generations Are Affected

1. Millennials (25-40)

-

First-time homebuyers facing unaffordable premiums

-

Auto insurance pain from urban living and rideshare use

2. Gen X (41-56)

-

Sandwich generation hit by health and home insurance spikes

-

Seeing long-term care insurance become prohibitively expensive

3. Baby Boomers (57-75)

-

Medicare Advantage plan premiums rising

-

Facing life insurance renewals at much higher rates

E. Industry-Specific Impacts

1. Healthcare Providers

-

Malpractice premiums up 15-25%

-

Forcing some doctors to retire early

2. Small Businesses

-

General liability up 30% for contractors

-

Many dropping coverage to stay afloat

3. Commercial Auto

-

Trucking companies seeing 40-60% increases

-

Leading to higher consumer goods prices

F. Consumer Protection Strategies

1. Smart Shopping Techniques

-

Always get 5+ comparable quotes

-

Consider regional insurers for better rates

-

Bundle policies for maximum discounts

2. Risk Reduction Methods

-

Install home security/sprinkler systems

-

Take defensive driving courses

-

Implement workplace safety programs

3. Alternative Solutions

-

Peer-to-peer insurance models

-

Captive insurance for businesses

-

Higher deductibles to lower premiums

G. Future Outlook (2024-2026)

-

Continued increases likely (5-15% annually)

-

More usage-based insurance models emerging

-

AI underwriting becoming more prevalent

-

Potential regulatory interventions

Conclusion

While premium increases appear unstoppable in the short term, informed consumers and businesses can take proactive steps to mitigate the financial pain. By understanding the root causes, shopping strategically, and implementing risk reduction measures, policyholders can navigate this challenging insurance market.

Tags: insurance premiums, rising insurance costs, climate change insurance, healthcare costs, insurance fraud, reinsurance market, legal system abuse, risk management, consumer protection, insurance shopping